Investment Approach

Industrial21‘s strategy is right at the heart of the German market, thus addressing a large deal-flow in the segment „SME companies + Privately owned + Industrial Sector“

Germany is ...

1. The largest and strongest European economy

- Largest European Economy (25% of EU27 GDP) with >3.8trn$ GDP

- Strongest economic growth (over last 10y) of large European countries

2. Dominated by SME companies (“Mittelstand“)

- Largest number of privately owned medium-sized companies in Europe

- #11k companies with >250 staff (thereof 40% in industry segments) vs. #6k in UK or #4k in France/ Italy)

3. The European manufacturing hub

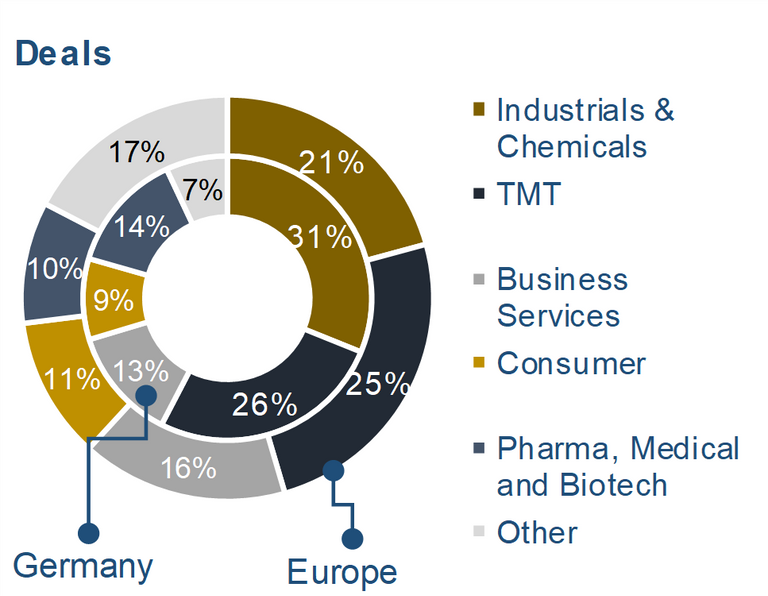

- Substantially higher share of buyouts in industrial companies due to…

- …overrepresentation of industrial sector in Germany with…

- …very high share of global “Hidden champions“ in industrial niches

4. Underinvested compared to other European markets

- Germany with substantially lower private equity penetration compared to UK / France

- No SME industry specialist buyout funds in Germany, only generalists

Industrial21 focuses on high-quality companies in industrial manufacturing and specialty distribution niches with a sustainable competitive advantage

What investment criteria are we looking for?

1. Industrial manufacturing and specialty distribution niches

Company characteristics

- Specialty building materials

- Aerospace and defense components

- Safety and regulated products

- Electrical and electronic equipment

- Measuring and testing equipment

- Flow control systems

- Automation and industrial technology

- Specialty chemicals

- Other industrial components and equipment

Rationale

- Recurring aftermarket-revenue base through significant share of spares, repairs, and consumables

- Often C-parts or mission-critical components with lower price sensitivity

- Less exposed to technological disruptions

2. Sustainable competitive advantage (SCA)

- Switching costs / Pricing power

- Network effects

- Branding power

- Regulatory barriers (e.g., IP protection)

- Structural barriers (e.g., access to scarce resources or transportation costs)

- Scale economies

- Typically, inflation-proof business system

- Strategy offers large pool of companies with SCA (product and IP-focus, “Hidden Champions“)

- Primaries often not fully aware of SCA and the implications for value generation and pricing power

- SCA are the foundation for value creation through hands-on approach

3. Resilient and strong financial basis

- EBITDA typically between 5-8m€

- Growing non-cyclical topline

- High contribution-/gross margin

- Double-digit EBITDA-margin

- High cash-conversion

- No customer or product dependencies

- Proprietary IP

- “Size Arbitrage” by moving EBITDA from <10m€ to >10m€

- “Turnkey Arbitrage” by moving asset from owner / operator to turnkey asset

- Attract global trade buyers through size and footprint expansion

- xxx